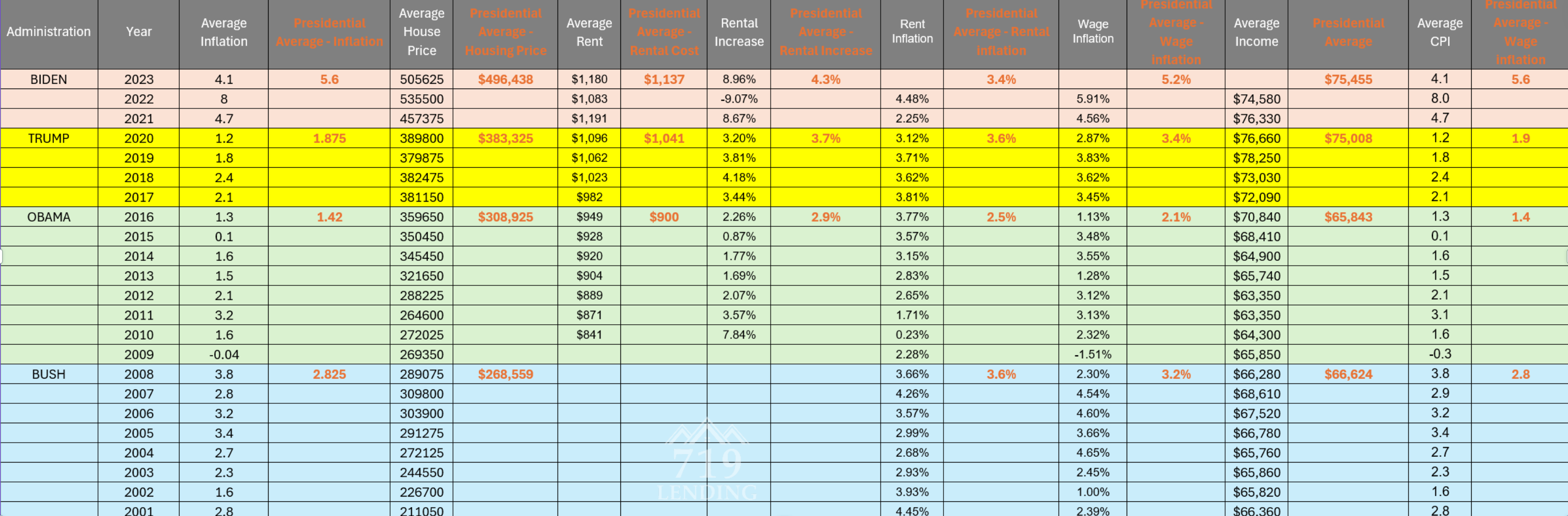

Deep Dive into Economic Indicators: Understanding Inflation, Housing, and Income under US Administrations In recent…

VIDEO: What Does Cutting the Fed Funds Rate Mean?

The Fed just cut the Fed Funds Rate, but what does that mean, really?

Have a VA Question? Contact Us

Need a VA Loan? Apply Today

Contrary to popular belief, when the Fed says they’re going to cut rates, that doesn’t directly impact mortgage rates or mortgage-backed securities. Let us explain.

The rate that the Fed is cutting is called the Fed Funds Rate. If they say they’re going to cut rates by a quarter of a point, they’re actually cutting the rate at which banks loan money to each other on an overnight basis. You see, banks have to hold a certain amount of reserve, so they have to hold 10% of whatever they would deposit that night. When the Fed cuts the Fed Funds Rate, this is the rate that is being cut.

“

So many factors affect consumer perception, confidence,

and ultimately, mortgage-backed securities.

”

So why do so many think that cutting this rate is tied to the mortgage rate?

Well, the announcement that the rate is dropping makes people think that it applies to mortgages. So, if cutting the Fed Funds Rate doesn’t affect mortgage rates, then what does?

That’s a legitimate question that can be answered with one word: everything—trade issues, market conditions, available jobs, the stock market, and so many other factors affect consumer perception, confidence, and ultimately, mortgage-backed securities.

If you’d like more information to help you understand exactly how the Fed Funds Rate cuts are impacting mortgages, don’t hesitate to reach out to us. We’d love to help you.