What You Need To Know About APOR Mortgage Regulations in 2024 As the financial landscape…

A Closer Look at Inflation, Housing, and Income under the Each Administration

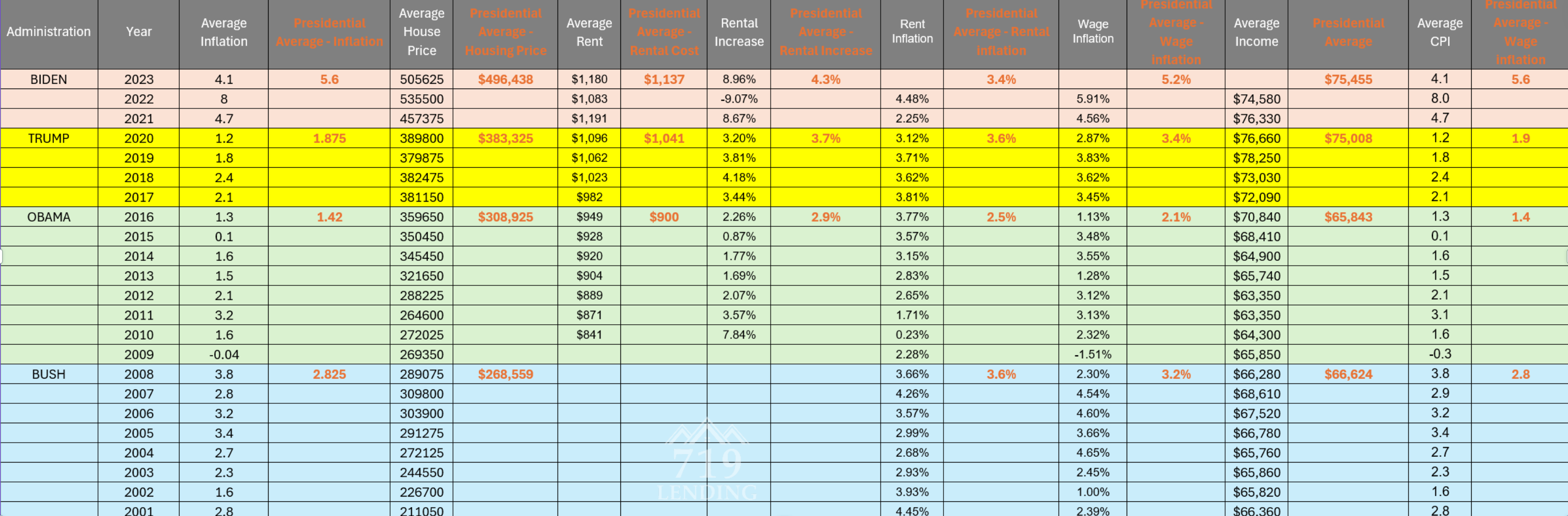

Deep Dive into Economic Indicators: Understanding Inflation, Housing, and Income under US Administrations

In recent years, the economic landscape in the United States has undergone significant shifts. For Colorado Springs residents, grasping these changes is crucial, particularly in the realms of real estate and personal finance. Today, we’re delving into key economic indicators from 2001 to 2023, examining their impact on our wallets and the role of a real estate agent in navigating these trends.

A Turbulent Journey of Inflation

Inflation, a topic of much debate in recent years, has seen its rates ebb and flow. These fluctuations have been evident during the tenures of various presidents. The table below offers a detailed look at the average inflation rates under the administrations of Biden, Trump, Obama, and Bush, highlighting the influence on interest rates in Colorado Springs.

Administration Average Inflation

Biden 5.6%

Trump 1.875%

Obama 1.42%

Bush 2.825%

Under Biden’s administration, inflation has taken us on a tumultuous journey, mirroring the broader economic challenges and recoveries of his term. The data underscores that, regardless of the president in office, inflation has consistently affected various aspects of life in Colorado Springs, from grocery expenses to interest rate adjustments.

The Highs and Lows of the Housing Market

The housing market has also experienced notable shifts. The average house prices in Colorado Springs have been on a rollercoaster, reflecting the market’s volatility. Here’s a glimpse into how home ownership costs have fluctuated during different presidential administrations:

Administration Average House Price

Biden $496,438

Trump $383,325

Obama $308,925

Bush $268,559

These figures underscore a burgeoning housing market in Colorado Springs, where soaring prices are driven by high demand and a tight supply, presenting challenges and opportunities for real estate agents, homeowners, and investors.

Renting: A Story of Steady Increase

Renting costs in Colorado Springs have steadily climbed over the years. The average rent has escalated from $900 during the Obama era to $1,137 under Biden, highlighting the importance of home loans in Colorado Springs for those aspiring to transition from renting to owning.

Administration Average Rent

Biden $1,137

Trump $1,041

Obama $900

The escalating costs have exerted pressure on renters in Colorado Springs, particularly for those endeavoring to amass savings for their own home. This situation underscores the need for mortgage assistance programs to support aspiring homeowners.

Income and Wages: The Struggle to Catch Up

In the economic landscape of Colorado Springs, average wages have endeavored to match the escalating costs. Despite these efforts, they’ve lagged behind the inflation rate, putting a strain on household budgets and prompting concerns about the interest rate.

Administration Average Income

Biden $75,455

Trump $76,660

Obama $70,840

Bush $66,280

While Colorado Springs has observed some wage growth, the battle to outpace inflation has been palpable, with the interest rate fluctuations further impacting household budgets nationwide.

Implications for Colorado Residents

For Colorado Springs residents, particularly those working with a real estate agent or mortgage broker, it’s crucial to keep abreast of economic trends. The real estate market presents a complex challenge for buyers, and renters are not exempt from stress. Additionally, being wellversed in wage trends is essential for effective financial planning and budgeting.

Looking Ahead

In the economic currents of Colorado Springs, staying wellinformed and seeking guidance from a real estate agent or mortgage broker can be pivotal. Prospective homebuyers should be wary of market volatility and might explore mortgage assistance programs, while renters ought to prepare for possible rent hikes. Monitoring income trends is also key to managing personal finances with acumen.

In the dynamic economic environment of Colorado Springs, being knowledgeable equips you to adeptly handle the challenges and seize the opportunities that arise. This is particularly true when working with a seasoned real estate agent who can provide valuable insights.

At 719 Lending At our Colorado Springs firm, we are dedicated to guiding you through these economic fluctuations. Whether you’re in the market for a new home or in need of personal finance advice, our team of mortgage brokers and lenders in Colorado Springs is ready to assist. Don’t hesitate to reach out for support.reach out to us for any of your real estate or finance needs in Colorado.

Conclusion

Navigating economic trends in Colorado Springs doesn’t have to be daunting. Armed with the right insights and resources, and possibly the assistance of a mortgage broker or real estate agent, you can approach these challenges with assurance. Staying informed and seeking expert advice are the cornerstones of making prudent financial decisions in an everevolving economy.

Remember, 719 Lending As your dedicated Colorado Springs mortgage broker, our expertise is here to help you navigate the everevolving trends and provide you with tailored guidance in your real estate and financial decisions. Whether you’re seeking a savvy real estate agent or need advice on the local market, we’re committed to ensuring your success. Contact us today for personalized advice and guidance.