VA Loan Options for Colorado Springs Investment Properties

Investing in real estate can be a lucrative opportunity, and for military members in Colorado Springs, VA loans offer a unique way to purchase investment properties. VA loans, also known as home loans for veterans, provide flexible options, low interest rates, and no private mortgage insurance requirements. In this blog, we will explore the benefits of using VA loans for investment properties in Colorado Springs, the eligibility requirements, the loan process, and address common misconceptions surrounding VA loans. If you are a military member or veteran looking to invest in Colorado Springs, VA loans can be a great option for you.

Understanding VA Loans in Colorado Springs

If you are in the military or a veteran, you may be eligible for a VA loan to purchase a home in Colorado Springs. VA loans, provided by the Department of Veterans Affairs, are home loans specifically designed for military members, veterans, and their families. These loans offer several advantages, including low interest rates, no down payment requirements, and flexible credit score criteria. Colorado Springs, with its growing real estate market and investment opportunities, is a perfect location for military members and veterans to consider using a VA loan for property investment.

What is a VA Loan?

A VA loan, short for Veterans Affairs loan, is a home loan program specifically designed for active duty military members, veterans, and eligible surviving spouses. VA loans are guaranteed by the Department of Veterans Affairs, which means that approved lenders are protected against loss in the event of a borrower default. This guarantee allows lenders to offer eligible borrowers better terms and more favorable interest rates than conventional loans. VA loans can be used for primary residences, but they can also be used for investment properties in certain cases, making them a great option for military members looking to build their real estate investment portfolios in Colorado Springs.

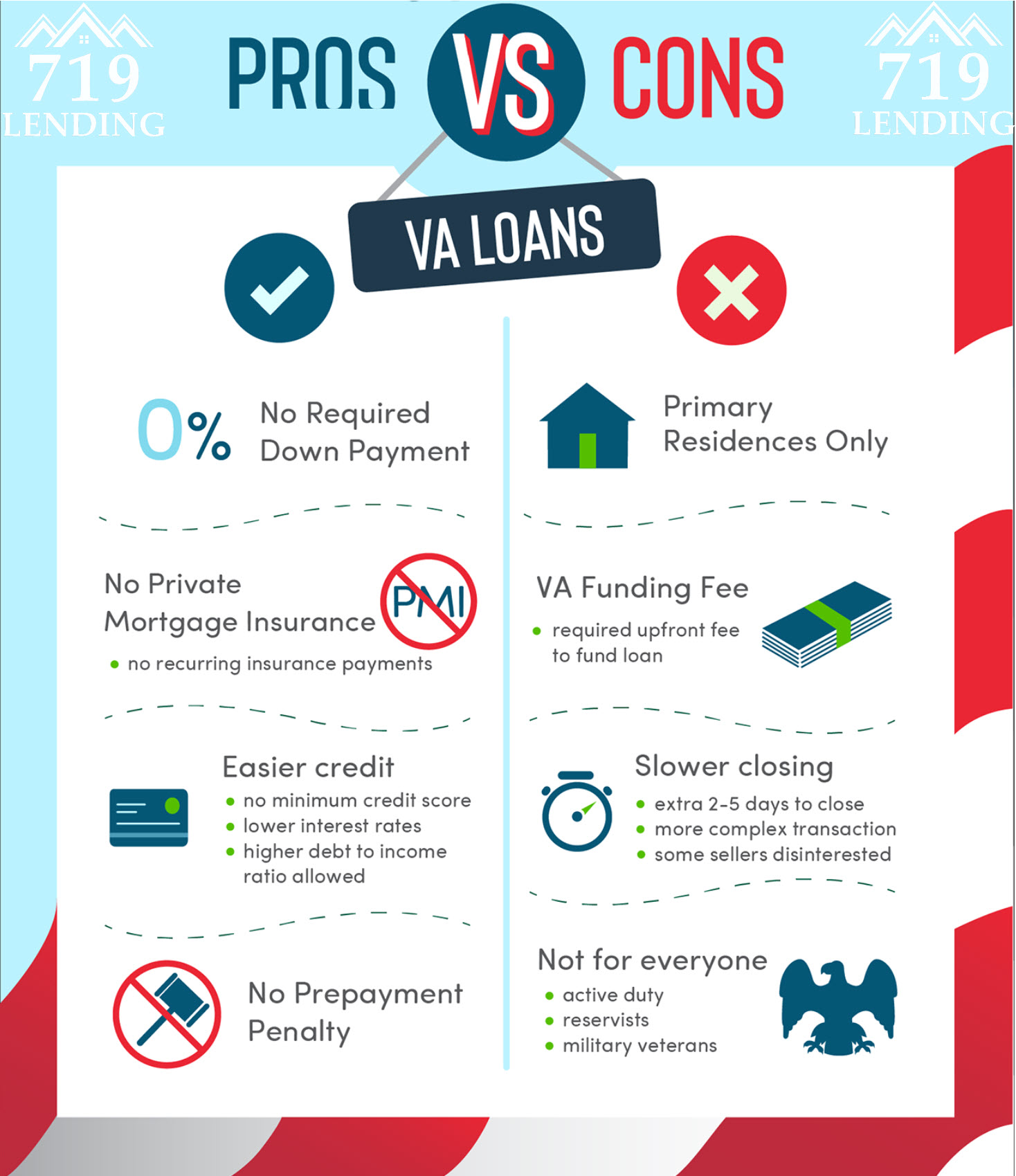

Advantages of VA Loans

VA loans for investment properties in Colorado Springs offer military members and veterans several advantages. One of the key advantages is the ability to purchase a property with no down payment, eliminating the need for a large upfront investment. Additionally, VA loans typically have lower interest rates compared to conventional loans, saving borrowers money over the life of the loan. VA loans also do not require private mortgage insurance, further reducing the monthly costs for borrowers. This unique combination of benefits makes VA loans a flexible and cost-effective option for investing in real estate in Colorado Springs.

Eligibility for VA Loans

Military members, veterans, and their families may be eligible for VA loans in Colorado Springs. Understanding the eligibility requirements is the first step in the loan process. To be eligible for a VA loan, you must meet certain criteria, including service requirements, credit score, and income requirements. Active duty service members, veterans, National Guard and Reserve members, and surviving spouses may all be eligible for VA loans. Determining your eligibility can be done by contacting a VA-approved lender or the Department of Veterans Affairs directly.

Who is Eligible?

VA loans in Colorado Springs are available for active duty service members, veterans, National Guard and Reserve members, and eligible surviving spouses of veterans. Active duty service members who have served a minimum term of service may be eligible for VA loans. National Guard and Reserve members who have completed a minimum period of service and have been discharged honorably may also qualify. Surviving spouses of veterans may be eligible for VA loans in certain circumstances, such as if the veteran spouse died as a result of service-related injuries. It is important to check with a VA-approved lender or the Department of Veterans Affairs for specific eligibility requirements.

How to Determine Your Eligibility

To determine your eligibility for a VA loan in Colorado Springs, you will need to assess your service history, credit score, and income. VA loan eligibility is based on the service requirements outlined by the Department of Veterans Affairs. Your credit score will also play a role in determining your eligibility, as lenders have specific credit score requirements for VA loans. Checking your credit score and ensuring it meets the lender’s requirements is an important step in the process. Consulting with a mortgage broker experienced in VA loans can help guide you through the eligibility determination process.

VA Loan Process in Colorado Springs

The VA loan process in Colorado Springs involves several steps, from prequalification to loan processing and underwriting. Understanding the process can help military members and veterans navigate the loan process more effectively. The steps typically include prequalification, property search and contract, loan processing and underwriting, and closing. Prequalification involves assessing your financial situation and credit score to determine how much you can borrow. The property search and contract phase involves finding a suitable property and securing a purchase agreement. Loan processing and underwriting involve the verification of your financial information, credit history, and the property itself. Finally, the closing process involves the transfer of ownership and the completion of the loan paperwork.

Prequalification and Preapproval

The VA loan process in Colorado Springs begins with prequalification and preapproval, which help establish the borrower’s buying power and potential loan amount. Prequalification involves a preliminary assessment of the borrower’s credit score, income, and financial situation to determine the loan amount for which they may be eligible. Preapproval, on the other hand, is a more in-depth process that involves a thorough examination of the borrower’s credit history, income, employment, and financial documentation. Preapproval provides the borrower with a conditional commitment from the lender, indicating the amount for which they are approved, subject to the property meeting the lender’s requirements.

Property Search and Contract

Once preapproval has been obtained, the next step in the VA loan process for investment properties in Colorado Springs is the property search and contract phase. This involves working with a real estate agent who is familiar with VA loan options and the local real estate market. The real estate agent can help you find suitable investment properties in Colorado Springs and guide you through the process of making an offer, negotiating, and securing a purchase agreement. It is important to consider the property’s value, condition, and potential rental income when searching for investment properties using a VA loan.

Loan Processing and Underwriting

After the property has been identified and a purchase agreement has been signed, the loan processing and underwriting phase begins. This involves the verification of the borrower’s financial information, credit history, and the property itself. The loan amount will be determined during this process, based on the appraised value of the property and the borrower’s financial situation. VA loans for investment properties in Colorado Springs often require the assessment of rental income for the property. Working with a mortgage broker or a VA-approved lender can help streamline the loan process and ensure a smooth underwriting process.

Investing in Colorado Springs with VA Loans

Investing in real estate can be a smart financial decision, and for military members in Colorado Springs, using VA loans for investment properties can provide a unique opportunity. Colorado Springs offers a growing real estate market, with the potential for property appreciation and rental income. VA loans for investment properties in Colorado Springs allow veterans to use their VA home loan benefits for real estate investment. Whether you are interested in single-unit properties, multi-unit properties, or vacation homes, VA loans can be a beneficial tool for military members looking to invest in Colorado Springs.

Benefits of Investing in Colorado Springs

Investing in Colorado Springs offers several advantages for military members and veterans using VA loans for investment properties. The city’s real estate market has been experiencing growth, making it an attractive location for property investment. Colorado Springs also offers the potential for rental income, with a strong demand for rental properties in the area. Investing in real estate can provide a long-term financial strategy, allowing veterans to build wealth and secure their financial future. By leveraging the benefits of VA loans for investment properties in Colorado Springs, military members can take advantage of the city’s real estate market and rental income potential.

How to Use VA Loans for Investment Properties

Using VA loans for investment properties in Colorado Springs can be a strategic way for veterans to utilize their VA home loan benefits for financial growth. Here are some key points to consider when using VA loans for investment properties:

- VA loans can be used for investment properties, not just primary residences.

- VA loans can help veterans expand their real estate investment portfolios.

- Rental income can be considered when assessing the loan amount for VA loans for investment properties.

- The property must meet the VA loan requirements for the loan to be approved.

Common Misconceptions about VA Loans

VA loans, like any financial product, can come with misconceptions. Let’s address some of the common misconceptions about VA loans for investment properties in Colorado Springs, and set the record straight.

Myth 1: VA Loans are Only for Primary Residences

Contrary to popular belief, VA loans can be used for investment properties, not just primary residences. Military members and veterans can use VA loans to purchase investment properties in Colorado Springs, allowing them to build their real estate investment portfolios. VA loans offer flexible options and low interest rates, making them a great choice for military members looking to invest in real estate in Colorado Springs.

Myth 2: VA Loans have High Interest Rates

Another misconception is that VA loans have high interest rates. In reality, VA loans for investment properties in Colorado Springs offer competitive interest rates, often lower than conventional loan options. This low interest rate can save borrowers money over the life of the loan and make investment properties more affordable. VA loans also do not require private mortgage insurance, further reducing the monthly costs for borrowers.

Myth 3: VA Loans are Difficult to Obtain

Contrary to the belief that VA loans are difficult to obtain, the process is actually streamlined for military members and veterans. VA loans for investment properties in Colorado Springs offer a fast approval process and a flexible loan process. By working with a mortgage broker experienced in VA loans, military members can navigate the loan process with ease and obtain a loan for their investment property in Colorado Springs.

Services Offered by 719 Lending

To further facilitate the VA loan process for investment properties in Colorado Springs, 719 Lending offers a variety of services. As a mortgage broker, 719 Lending specializes in VA loans, conventional loans, and VA streamline refinance options. The company provides fast approval mortgage loans, flexible mortgage solutions, and a step-by-step process to guide military members and veterans through the loan process. With a focus on customer service, 719 Lending aims to provide military members in Colorado Springs with the best mortgage solutions for their investment property needs.

Overview of Loan Options

719 Lending offers a comprehensive overview of loan options, including VA loans for investment properties in Colorado Springs. In addition to VA loans, the company provides conventional loan options for military members and veterans. VA streamline refinance options are also available for borrowers looking to refinance their existing VA loans. With access to a wide range of loan options, 719 Lending can tailor a mortgage solution to meet the unique needs of military members and veterans in Colorado Springs.

Why Choose 719 Lending for Your Mortgage Needs

When it comes to mortgage needs, 719 Lending is a trusted choice for military members and veterans in Colorado Springs. As a mortgage broker specializing in VA loans, 719 Lending has the expertise and knowledge to guide borrowers through the loan process. The company mortgage loans, ensuring a smooth and efficient process for borrowers. With a focus on customer service and a deep understanding of the unique needs of military members and veterans, 719 Lending is the ideal partner for your mortgage needs in Colorado Springs.

Frequently Asked Questions

What are the benefits of using a VA loan for an investment property purchase?

Using a VA loan for an investment property purchase has benefits such as low interest rates, no private mortgage insurance requirements, flexible loan options, and the potential to build wealth through property appreciation and rental income.

Are there any specific requirements or qualifications for using a VA loan on an investment property?

VA loans can be used for investment properties, but there are additional requirements and qualifications. These include meeting VA property requirements, ensuring eligibility, demonstrating rental income potential, and consulting with a VA-approved lender in Colorado Springs for specific details.

How can I determine if I am eligible for a VA loan?

Determining your eligibility for a VA loan is crucial. Factors such as military service history, discharge status, and more play a role. To confirm eligibility, the VA provides a Certificate of Eligibility (COE). Active-duty service members, veterans, National Guard and Reserve members, and surviving spouses may be eligible. Contact an experienced lender or the VA directly for assistance.

Conclusion

VA loans present a unique opportunity for individuals looking to invest in Colorado Springs. The advantages of VA loans, such as no down payment and competitive interest rates, make them an attractive option for those interested in investment properties. Contrary to common misconceptions, VA loans can be used for investment properties and are not limited to primary residences. If you’re considering investing in Colorado Springs, take advantage of the benefits of VA loans and contact us today to discuss your options.