Coronavirus & Home Prices: 5 Ways It Could Effect Home Prices

Bonnie Sinnock – Capital Markets Editor- https://www.nationalmortgagenews.com/

Nevertheless, John Dolan — an independent market maker in futures based on the Case-Shiller 10-city index and an expert witness with more than three decades of experience with structured securities in the mortgage market — already has some thoughts on how the coronavirus is affecting home prices & housing trends now, and will in the future.

From an intensified homeowner preference for smaller cities to increased downward pressure on housing prices in states experiencing pension fund challenges, the virus has several impacts mortgage businesses should prepare for, including the five that follow.

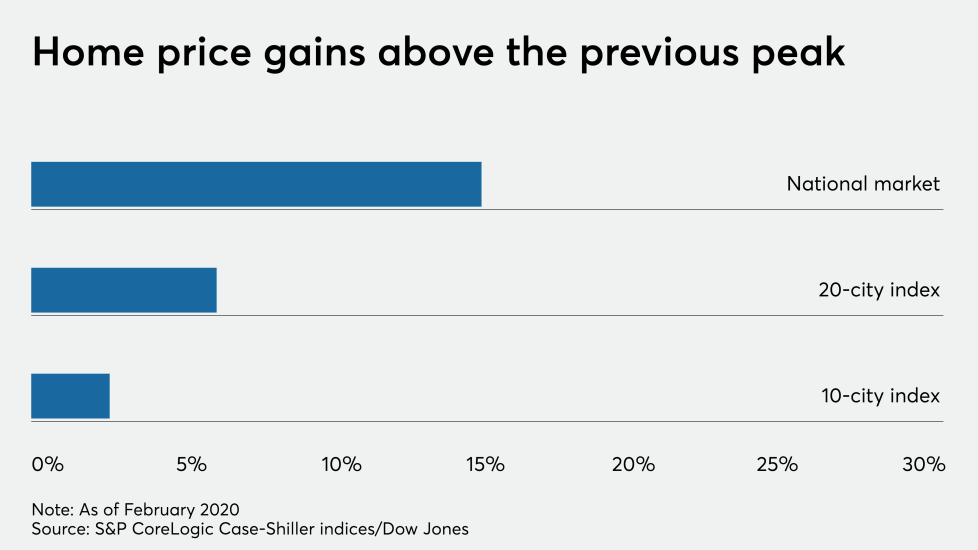

For the housing market as a whole, home prices have been up more than 15% compared with the past peak reached just before the Great Recession more than a decade ago.

But within the 20-city subindex that generally represents only the larger metropolitan areas, the gains above the past peak are relatively lower at 6.4%. Further narrow that group down to the 10-city index, and prices are only 2.7% above their past peak.

That likely reflects affordability constraints in large urban markets like San Francisco, which have driven buyers more toward second- and third-tier cities, leading to more pronounced relative gains in those areas that boost the overall index.

Since the Case Shiller 10-city index is primarily focused on the largest urban areas in the country, “it might reflect a more negative home price path than is actually occurring in other areas like the second- and third-tier cities that new buyers may gravitate to,” said Dolan.

That trend could intensify not only because the virus is expected to put more strain on the economy, but because some of the attractions in large metro areas are inaccessible due to social distancing.

“The benefits of dense urban areas — like sports, global airports and concerts — have dropped,” Dolan said.

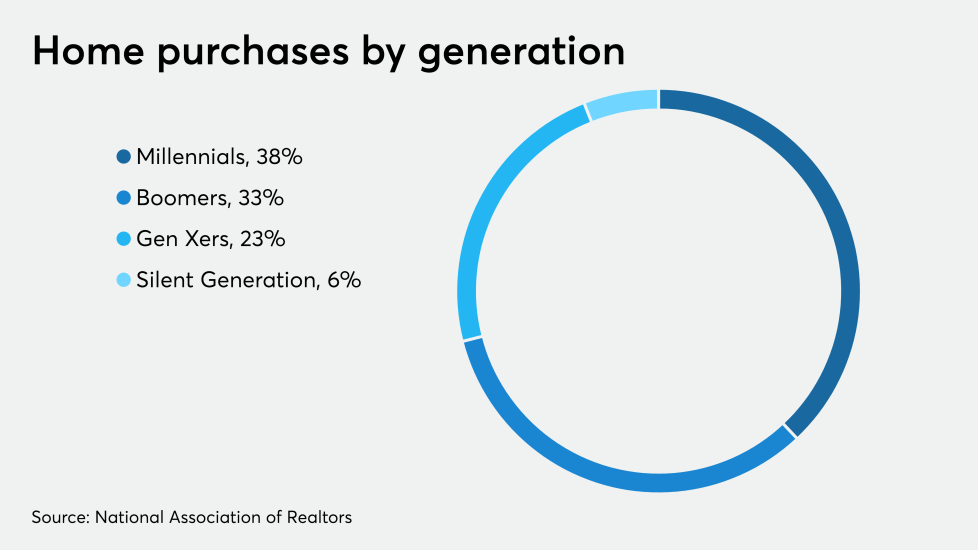

As the generation that dominates the working population in the United States, millennials have been in focus as key homebuyers, but job instability may make homeownership look less desirable to them.

“Millennials have been part of a demographic wave that supports housing, but there are questions about whether they will going forward, like, do they still have jobs or do they even want to be in one place if they have to move around to find jobs?” Dolan said. “Renting gives them flexibility. Homeownership does not.”

The uncertainty introduced to the capital markets by the coronavirus outbreak has intensified pension fund issues that already existed in states like Illinois, New Jersey and Connecticut, and that could put additional strain on state budgets — and housing markets — in these jurisdictions.

“A decline in state revenues and a decline in the assets backing pension plans could lead states to turn to other sources of revenue, and that could include property taxes,” Dolan said. “They may turn to things like transfer taxes to make up a shortfall in the budget or cut services. That’s negative for home prices. If you do things like start defunding schools, people may move.”

Most market participants are preparing for a single coronavirus-related downturn in the housing market, but some are concerned there could be a second wave of COVID-19 infections, which would cause further disruption.

“If we don’t get a second wave, eventually housing improves again,” Dolan said. “On the other hand, if we do get a second wave, here and globally, the economy might collapse even further. It’s maybe a small probability, but it could have a large impact if it happens.”

With impacts from the coronavirus hurting employment and making it more difficult to sell certain types of loans to secondary market investors, mortgage companies may tighten underwriting, one other unexpected way coronavirus is affecting home prices and real estate.

The extent to which they do could feed into a vicious cycle that creates additional downward pressure on housing values.

“If you start requiring things people don’t have, you are going to remove some of the buyer support for the market and it’s going to undermine home prices,” Dolan said.