Homeownership in Colorado Springs is a symbol of the American Dream, yet some have faced…

Breaking – NAR Lawsuit – Fannie Mae Update

Breaking – NAR Lawsuit – Fannie Mae Update

In the dynamic world of real estate, policy changes can significantly affect everyone involved in the housing market, from agents and loan officers to buyers and sellers. Two major entities, known as GSEs, are at the forefront of mortgage reform, impacting the landscape.

Fannie Mae

and

Freddie Mac

These entities, pivotal in the housing market, recently unveiled policy updates that merit attention. This article will explore these changes, shedding light on the Fannie Mae mission and Freddie Mac’s stance on interested party contributions, and their potential effects on the industry.

Fannie Mae and Freddie Mac Policy Updates

Early today, both Fannie Mae and Freddie Mac made announcements regarding policy clarifications that could alter the standard practices in real estate transactions. These updates, central to mortgage reform, specifically address real estate agent fees among other aspects (seller concessions, buyer’s agent fees, and Interested Party Contributions (IPCs)).

Seller Concessions

Seller concessions, which are funds sellers provide to buyers to help cover legitimate closing costs like title fees and appraisal costs, have been further clarified by Fannie Mae and Freddie Mac. This update illuminates the limitations and allowances for these financing concessions, providing clearer guidelines for settlements.

Fannie Mae typically allows seller concessions to vary from 2 to 9% of the loan closing costs. However, there was some ambiguity regarding whether a buyer’s real estate agent fee could be included in these concessions. The latest policy clarification has resolved this by stating it will depend on the customary practices of the area, incorporating considerations for financing concessions.

Buyer’s Agent Fees

The recent policy update has made clear the position on buyer’s agent fees. If such fees are customary in the area, Fannie Mae and Freddie Mac will permit their inclusion in seller concessions. This decision could influence how funds are allocated towards actual closing costs or other expenses, a point of interest for the National Association of Realtors.

Interested Party Contributions (IPCs)

An IPC, or interested party contribution, is a payment from the seller to cover the buyer’s agent’s fee, which was previously viewed with skepticism except under specific conditions. The latest update introduces more flexibility with IPCs, allowing them to be included if customary in the area without affecting the usual seller concession limits. This change is poised to maintain business as usual for most real estate transactions.

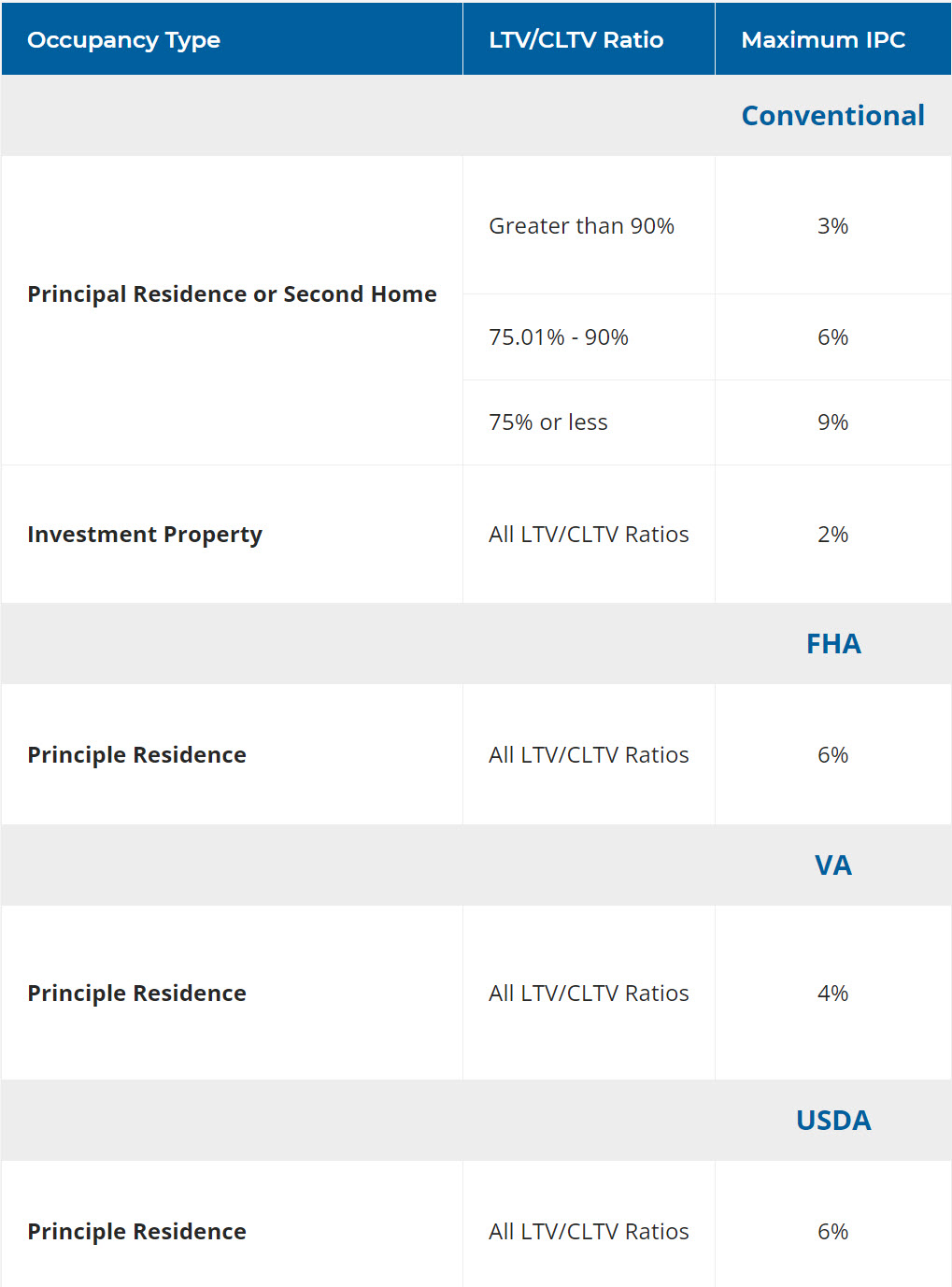

Below are the standard concession limits (not IPC)

The Impact on Different Agencies

This clarification comes from Fannie Mae and Freddie Mac, key players in the real estate sector. However, other agencies like the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) have their unique positions on these matters, highlighting the complexity of VA loans and FHA guidelines.

While the FHA has issued a similar clarification, the VA has yet to comment on this issue. Currently, VA loans do not accommodate any agent fees, primarily because their guidelines suggest it’s customary for the seller to cover these costs. Yet, with Fannie Mae and Freddie Mac’s recent policy adjustments, we might soon see a shift in the VA’s stance.

Conclusion

The policy updates from Fannie Mae and Freddie Mac have brought much-needed clarity on several fronts, facilitating smoother transactions within the real estate industry. These changes promise a more structured approach to handling seller concessions, buyer’s agent fees, and IPCs, ensuring a more streamlined process for all parties involved.

For more detailed information, check out the Fannie Mae and Freddie Mac policy updates and Freddie IPC guidelines.

For more on Colorado real estate and finance, keep visiting 719 Lending. We offer expert insights to help you navigate the ever-changing world of real estate. Stay ahead of the curve with 719 Lending.

Call to action: Don’t forget to bookmark our website and subscribe to our newsletter to stay updated on the latest developments in the real estate industry.