Breaking - NAR Lawsuit - Fannie Mae Update In the dynamic world of…

Section 184 HUD Loan: Housing for Native American Families

Navigating home financing can be daunting, especially for Native American families seeking homeownership opportunities.

At 719 Lending, we provide specialized guidance on Section 184 HUD Loans, designed to help these families achieve the dream of owning a home in Colorado with favorable terms and support.

Expertise meets affordability.

Eligible Borrowers

- American Indians or Alaska Natives who are members of a federally recognized tribe

- Federally recognized Indian tribes

- Tribally designated housing entities

- Indian Housing Authorities

Native Hawaiians can access homeownership loans through the Section 184A Program.

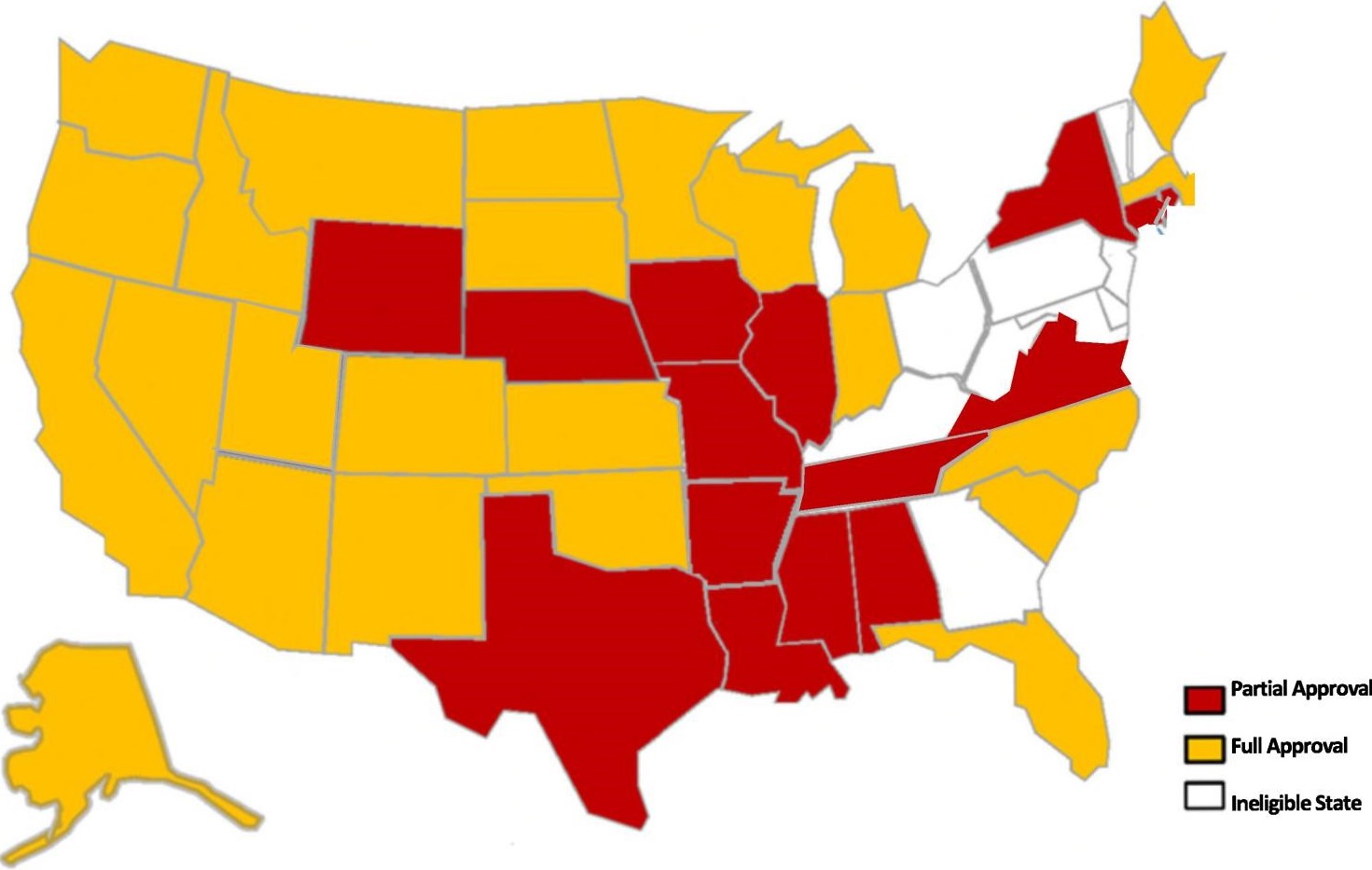

Eligible Areas

Loans must be made in an eligible area. The program has grown to include eligible areas beyond tribal trust land. Click on the links below to determined participating States and counties across the country

Unlocking Homeownership with Section 184

Exploring the benefits of Section 184 can ignite a pathway to homeownership that is typically more accessible and cost-effective. Here at 719 Lending, our tailored assistance simplifies the process, making the dream of owning a home within reach for Native American families seeking stability and a place to flourish in Colorado Springs.

Our know-how transforms complexity into clarity, ensuring a smooth journey through the unique aspects of Section 184 loans. Trust us to guide you to your new Colorado home with professionalism and local expertise.

Applications Made Simple

Tackling the Section 184 HUD Loan application may seem complex, but 719 Lending streamlines each step with expert precision, ensuring a frictionless experience for you.

Section 184 loans offer extensive cost savings, reducing the financial barriers to homeownership for Native American families.

Embarking on this journey requires the right companion—719 Lending is your reliable navigator through the intricate details, dedicated to securing your foothold in Colorado real estate.

Delivering the keys to your future home begins with our personal touch—crafting a straightforward application process for a loan that opens doors and fosters community roots in Colorado Springs.

Advantages for Native American Buyers

Lower Down Payments Simplify Homeownership.

The Section 184 HUD Loan provides a remarkable opportunity for Native American families aspiring to own a home. With a minimum down payment as low as 2.25% for loans over $50,000 and 1.25% for loans under that threshold, it’s financially accessible. Moreover, gifted funds can be used to contribute towards this down payment.

Credit Flexibility Eases Qualification.

Loan qualification criteria can be a significant hurdle, but not so with Section 184. The program has flexible credit requirements, making it easier to qualify, even if your credit history isn’t perfect.

Low-Interest Rates Reduce Monthly Payments.

It’s hard to ignore the financial benefits—especially the low interest rates that translate into affordable monthly payments. With the cost of borrowing reduced, homeownership becomes more attainable and sustainable over the life of the loan.

Limited Fees Prevent Unforeseen Costs.

Applicants can look forward to transparent and limited fees. Section 184 loans do not come with hidden charges or mortgage insurance premiums that typically inflate loan expenses. This straightforward approach to fees promotes affordability and trust in the lending process.

Exclusive to Native American Home Buyers.

Finally, the exclusivity of the Section 184 HUD Loan program ensures it’s tailor-made for the needs of Native American buyers. It represents a commitment to support the communities’ unique circumstances and cultural heritage, fostering home ownership while preserving identity.

Section 184 Loan Benefits

Navigating the real estate landscape of Colorado Springs with a Section 184 HUD Loan unlocks an array of advantages for Native American families. Picture this: low down payment requirements that make stepping into a new home less of a financial burden from the outset. Typically around 2.25% for loans over $50,000 and only 1.25% for loans under, this small initial investment opens doors to home ownership that might otherwise seem closed. Moreover, the security of a government-backed loan and the provision of a 30-year fixed-rate loan option create a stable financial future, offering peace of mind and predictability in your housing costs amidst the ever-changing Colorado real estate market.

Low Down Payment and Flexible Rates

Affordability is at the core here.

Stride into home ownership with confidence, knowing that fiscal hurdles are diminished. For those eyeing the dynamic Colorado Springs housing market, a Section 184 HUD Loan provides a financial palette ripe for personalization. With flexible interest rates that adapt to market changes, and the potential to negotiate payment plans, borrowers benefit from a uniquely adaptable home financing solution. Consequently, the fear of fluctuating rates becomes less of a barrier to entering the housing market.

Stress less about steep upfront costs.

Low down payments translate to accessibility – it’s that simple. With only a fraction of the property value required upfront — often just 1.25% to 2.25% depending on the loan amount — you can allocate funds to other essential aspects of purchasing a home. This significant reduction in initial costs enables aspiring homeowners to invest in their futures without depleting resources.

Your dreams of a Colorado Springs property, realistically within reach.

The enticing terms of the Section 184 loan collide with favorable market conditions, ushering in an opportune moment to secure a place you’ll call home. The Colorado real estate landscape in 2023 positions the Section 184 loan as a pivotal financial tool. Explore this avenue through 719 Lending’s expertise to navigate the complexities of mortgage planning with confidence and ease.

Eligibility Criteria Explained

Native American Heritage is a must.

To be eligible for a Section 184 loan, Native American heritage plays a pivotal role. You must be an enrolled member of a federally recognized tribe, or an Alaska Native village. This is a fundamental requirement, as the program is tailored to enhance access to homeownership within Native American communities. Moreover, proof of this heritage is a mandatory part of the application process.

Income and credit requirements must align.

Your financial health matters. For a Section 184 loan, your income and credit history will be assessed to ensure affordability and responsibility. Typically, you must demonstrate stable, reliable income and maintain a credit score that meets the program’s standards, though these are generally more lenient than traditional loans.

Occupancy As Your Primary Residence.

This loan must finance your primary residence – an investment property or second home does not qualify. The property you wish to purchase with a Section 184 loan must be your primary domicile, where you intend to live for most of the year.

Location Within an Eligible Area is Imperative.

Lastly, the property’s location is key. It must sit within an eligible area, which includes certain Indian areas or approved areas in a participating state. This ensures that the program fulfills its purpose of fostering community development and sustainability among Native American populations.

Navigating the Loan Process

Embarking on the Section 184 loan journey requires some navigation through financial prerequisites, akin to preparing for a trek across the tranquil yet challenging Colorado Springs landscape. Just as having the right gear is crucial for exploring the Rockies, preparing your financial portfolio with the assistance of experts at 719 Lending can pave the way to a seamless home buying experience.

Diving into the loan application, it’s much like decoding a complex map. You’ll encounter terms like “debt-to-income ratio” and hit checkpoints such as credit checks and employment verification. Fear not, for the team at 719 Lending is geared up to guide every step of the way, ensuring that you harness all the benefits the Section 184 loan has to offer. Visit our website, www.719lending.com, and let’s start mapping out your home financing route today.

From Pre-Approval to Closing

Navigating from pre-approval to the closing of your home can seem daunting, but with methodical steps, it’s a journey well-marked.

- Pre-Approval: Obtain pre-approval for a mortgage to understand your budget.

- Property Search: With a budget in mind, search for your ideal home in the Colorado Springs area.

- Offer and Negotiation: Make an offer on the property and negotiate terms with the seller.

- Loan Application: Complete the full loan application with detailed financial documentation.

- Home Inspection and Appraisal: Schedule a thorough inspection and appraisal to ensure value and identify any issues.

- Underwriting: Await the underwriter’s review for loan approval conditions, if any.

- Final Approval: Once approved, a closing date is set and final loan documents are prepared.

- Closing: Complete the signing of documents, pay closing costs, and receive the keys to your new home.

Once your loan application is underway, stay in contact with your lender for any additional information they may need.

Finally, the closing day will arrive where you’ll review and sign a host of legal documents—a moment to celebrate the start of a new chapter.

Common Hurdles and How to Overcome Them

Navigating loan processes can be daunting.

Identifying potential roadblocks early is key to a smooth transaction. Among the common challenges faced by Section 184 loan applicants are credit issues, income verification complexities, and navigating the unique requirements associated with tribal land. Proactively, you should prepare by organizing financial documents, repairing credit scores, and understanding the specific stipulations tied to tribal properties. At 719 Lending, we’re primed to guide you through these intricacies with expertise.

Ensure your credit profile is in top shape.

A seamless loan application hinges on – and is bolstered by – a clean credit report. Erroneous entries on your credit report can severely impact your chances of loan approval. It’s wise to review your credit history well in advance to correct any inaccuracies. 719 Lending can help you understand the nuances in preparing your credit for the Section 184 HUD Loan.

Be familiar with the property eligibility guidelines.

Navigating property qualifications is crucial. The Section 184 HUD Loan comes with specific conditions relating to the land and home you aim to purchase. Ensuring the property you’re interested in aligns with these guidelines is paramount. 719 Lending is keenly aware of the 2023 updates and is ready to help you navigate these criteria ensuring your chosen home meets the necessary qualifications.

Enhancing Native American Communities

Diving into home ownership can uplift Native American communities, fostering stability and economic growth within the fabric of these unique cultures. At 719 Lending, we don’t just facilitate access to the Section 184 HUD Loan; we champion the empowerment it brings to native families. With a heart for Colorado Springs and a spirit of collaboration, we’re dedicated to strengthening the communal bonds through sustainable home financing options. Embrace the future with us, creating homes that resonate with tradition and promise.

The Impact on Local Housing

The Section 184 HUD Loan profoundly transforms Colorado Springs’ real estate landscape, accelerating the availability of affordable housing in the area and fostering equitable opportunities for Native American families. Such changes cement 719 Lending as a pillar of the community, channeling growth toward inclusivity and diversity.

Homeownership rates in Native communities rise when HUD’s resources effectively reach the intended recipients. It’s a catalyst for change, especially here in Colorado Springs, where 719 Lending is poised to guide you through the process.

Moreover, this initiative supports not just individual families, but the entire community’s infrastructure. The ripple effect (schools behaving better, property values increasing) forms a robust foundation for future generations to thrive on.

Investment in housing is akin to sowing seeds of prosperity that will blossom into vibrant neighborhoods. The assurance of quality housing benefits everyone, aligning with 719 Lending’s commitment to nurturing Colorado Springs’ economic vitality and diversity.

With each approved loan, we witness an infusion of pride and culture into our neighborhoods, enriching the local tapestry. It points towards a future where Native American heritage is not only preserved but celebrated in the very structure of our local housing market.

Fundamentally, homes built on the strength of the Section 184 HUD Loan are more than shelters. They represent dreams realized and serve as a beacon of opportunity, with 719 Lending ready to illuminate the path for every Native American family seeking to own a piece of Colorado Springs.

Success Stories and Testimonials

At 719 Lending, we revel in the successes of our clients. Witnessing first-time homeowners unlock their dreams is beyond rewarding.

Since pioneering our Section 184 HUD Loan services, tales of triumph have flourished. Native American families in Colorado Springs have transformed their aspirations into tangible realities with our dedicated support.

Among these, a heartwarming story blossoms: A young couple’s journey from rental uncertainty to proud homeownership. Through the Section 184 HUD Loan, they planted roots in a community they now cherish.

Their success is mirrored in many others who have navigated the home-buying process with us. Each client’s triumph reinforces our commitment to providing personalized, understanding guidance for every prospective buyer.

The testimonials that paint our storied legacy speak volumes. They inspire us to continue fostering homeownership dreams with passion and expertise.