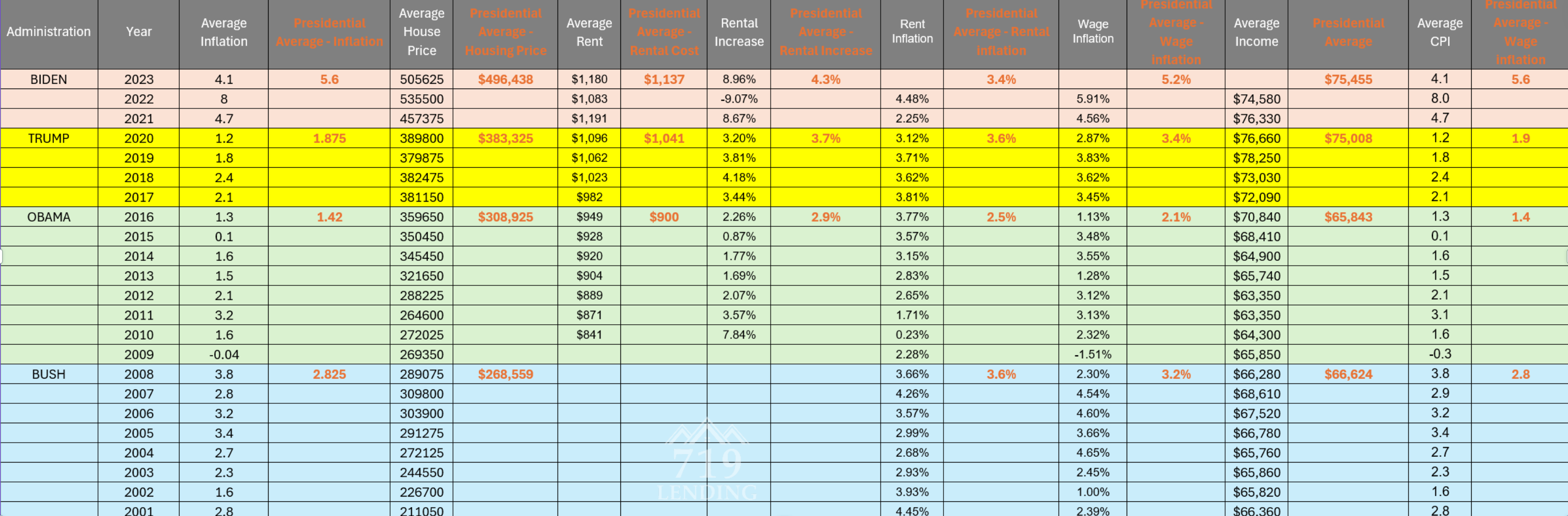

Deep Dive into Economic Indicators: Understanding Inflation, Housing, and Income under US Administrations In recent…

How the Ukraine-Russia Conflict Is Affecting Mortgage Rates

Here’s a brief update with the latest news on mortgage interest rates.

If you have clients who are out house shopping right now, I wanted to quickly give you an update on interest rates and what they’re doing to buying power. Rates have consistently gone up in the last few months. A $450,000 pre-approval from a few months ago may only be a $400,000 pre-approval today.

Here’s the crazy part: Everything in the market is very volatile, and things can change due to outside factors. Ukraine is being attacked by Russia right now, which is killing Russia‘s stock market. Believe it or not, rates have dropped as a result. They’ve gone down by nearly a quarter of a point with that political uncertainty.

Anything can affect interest rates, but one thing we know that will affect interest rates is the Federal Reserve raising the fund rate. How much will they raise it? It could be 50 basis points or 25 basis points.

Interest rates have decreased due to the Russia–Ukraine conflict.

When you have a buyer looking to purchase and you’re still out shopping after a few months, you need to get in touch with their loan officer to make sure your buyer is still qualified for the same amount. They may not be.

If you have any questions about interest rates, where they’re headed, or anything else related to the mortgage world, don’t hesitate to reach out via phone or email. We look forward to hearing from you soon.