What is a VA Loan? At 719 Lending, we're well-versed in addressing inquiries related…

Credit Score Requirements

Credit Score Requirements

Minimum credit score

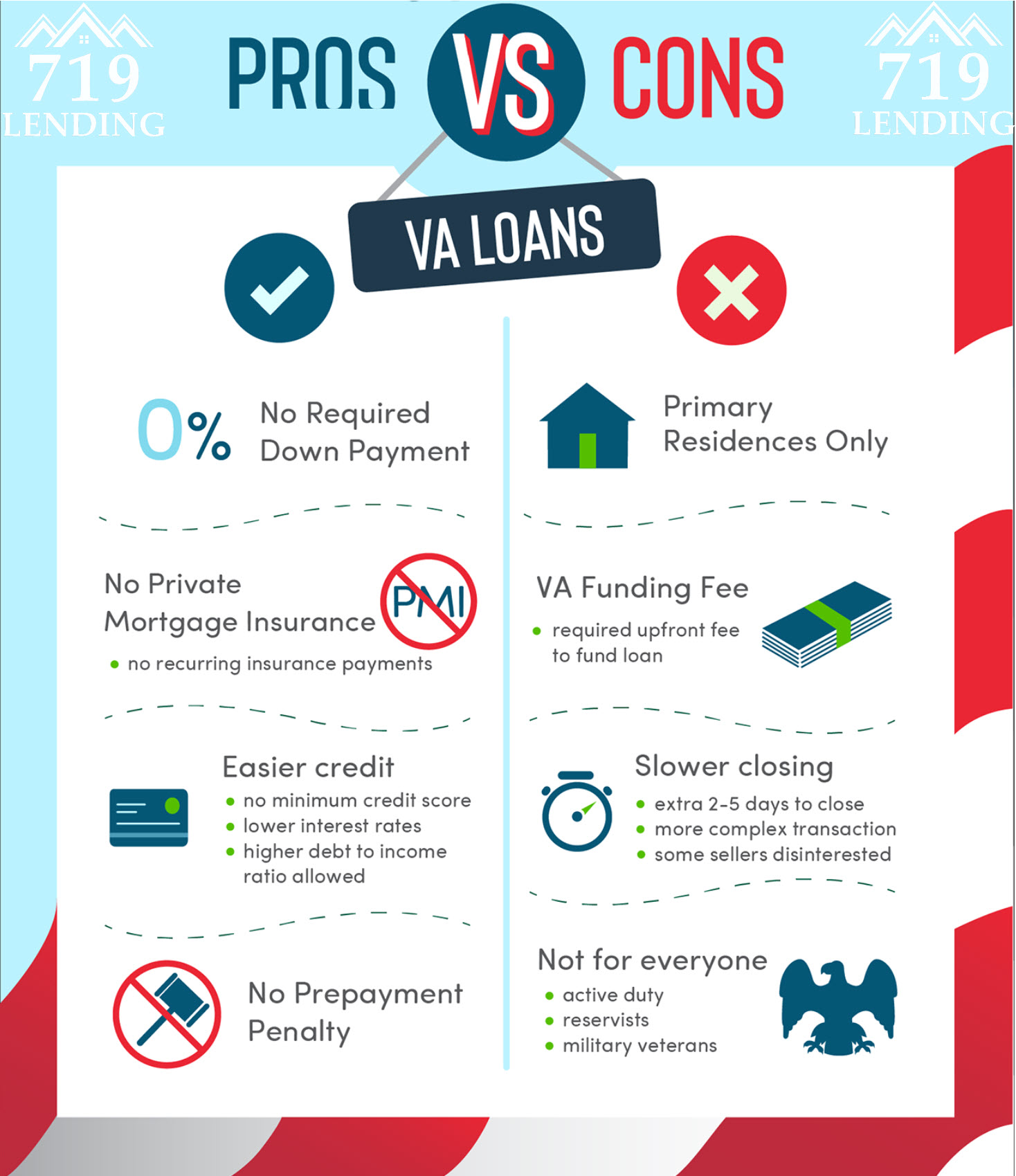

Did you know VA does not have any credit score requirements? While that’s true, most lenders do have requirements, and some lenders are more relaxed than others when it comes to your credit score. Most lenders like you to have at least a 580-credit score to qualify. However, if you have below a 580-credit score, not all hope is lost.

Your credit score will help to determine a lot in your qualifying. As an example the better your credit score usually results in a better interest rate saving you a lot of money over time.

Even if your credit is in the 600-700 range, there is no guarantee the Underwriter will approve your loan. A credit score is just one of many elements in determining your qualification.

Mortgage companies use an approval process called an “AUS” or “automated underwriting system.” Fannie Mae and Freddie Mac provide these automated underwriting systems in most cases and help to streamline the approval process.

If you receive an approval from the AUS, you may be allowed to provide less paperwork, have a faster closing time, and obtain more favorable terms on your loan. Make sure to ask your lender if you received approval in their AUS.

If your AUS findings come back less than favorable, two things should happen.

-

The first thing that should happen is that your loan officer should give you a clear credit plan to help you work towards homeownership.

-

The second thing that should happen; you should ask if you qualify for a “manual underwrite.” Manual underwriting is a process that allows an underwriter to bypass the AUS findings to see if you are eligible.

Keep in mind; manual underwriting does put more restrictions on you. As an example, your debt to income ratios will be looked at a lot closer.

Moreover, the underwriter will be reviewing what happened to your credit in the first place and see if you’ve taken corrective actions.

The Underwriter will be asking questions such as:

-

Has there been any significant credit issues in the last 12 months?

-

Was the problem related to medical?

-

Were there any bankruptcies or foreclosures?

-

Does the applicant have credit depth (aka – multiple accounts with a 12-month history)?