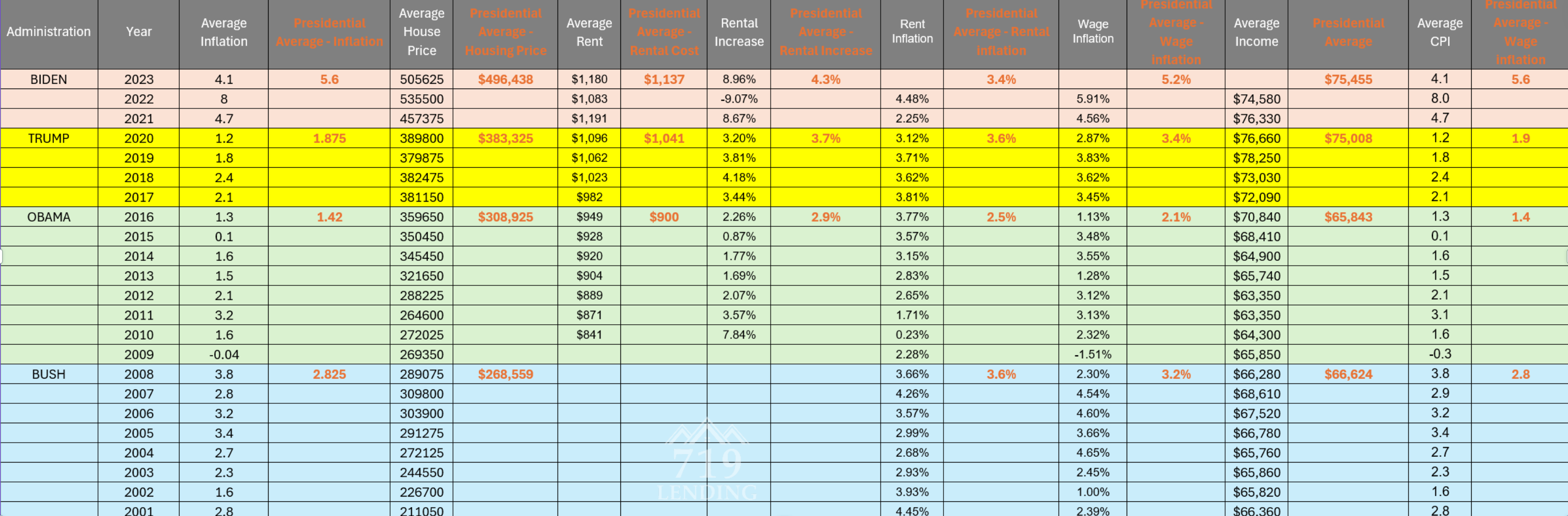

Deep Dive into Economic Indicators: Understanding Inflation, Housing, and Income under US Administrations In recent…

What You Need to Know about the USDA Loan in Colorado Springs

Are you interested in moving to a rural or less populated area? The U.S. Department of Agriculture offers a loan specifically made for homebuyers who want to purchase in these areas and meet certain other criteria. Read on to find out if the USDA loan is something you should consider.

Who Can Use the USDA Loan?

Homes and purchasers must meet certain criteria in order to be eligible for the USDA loan.

The homebuyer must fall within the moderate income, low income, or very-low income limits based on their county and state. The number of individuals in the household is also taken into consideration when determining these limits.

The home must be within one of the areas approved by the USDA. These areas are generally in rural or suburban locations. Using the property lookup tool on the USDA website, you can determine if your potential new home is in an approved area.

Qualifying borrowers can purchase a home without a down payment. This allows those that fall within the income limits to buy a home in rural areas, increasing their own potential to increased prosperity and further investing in the community.

USDA Loans – Not Just for Farms

While the program is administered by the U.S. Department of Agriculture, it is not designed just for farm or rural use. Many of the approved areas fall in suburban locations, small towns, and within city limits. The USDA loan can be used to purchase a single family home as long as it is in an approved area.

The USDA loan can also be used for farm properties, including multi-family housing for domestic farm laborers. USDA loans must be used for the purchase of a primary residence. This means that applicants need to live in the home themselves after they are approved for the loan and close on the purchase of their new home.