What is a VA Loan? At 719 Lending, we're well-versed in addressing inquiries related…

Show me your rates

Show me your rates

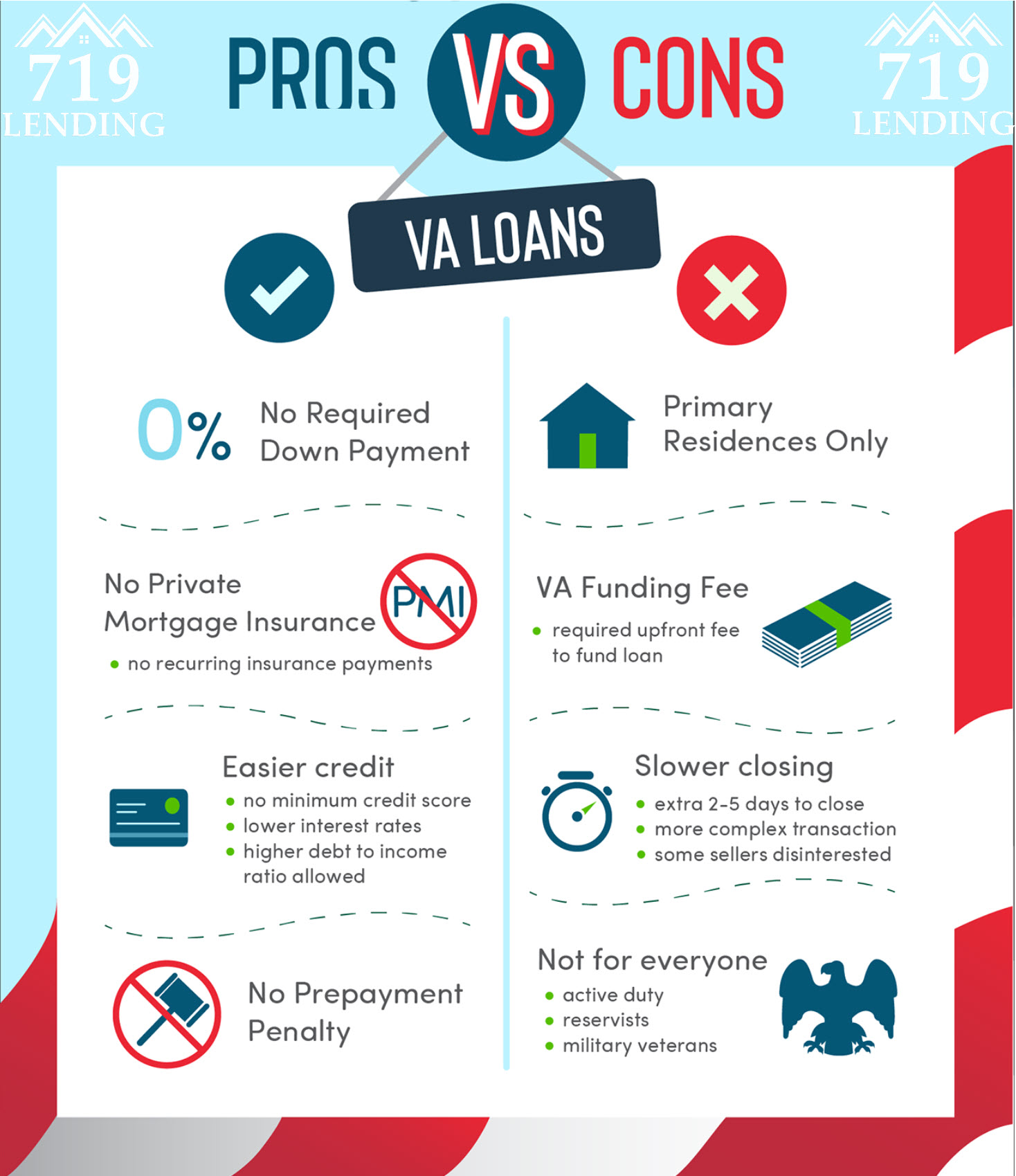

Interest rates on VA loans are traditionally far better than conventional loans. Fannie Mae and Freddie Mac loans, a.k.a. Conventional loans, also come with higher down payment requirements and typically mortgage insurance. VA is the only loan that allows no money down, incredible interest rates and no private mortgage insurance.

One thing many people don’t know is that VA does not set the interest rate. Interest rates are set by competing lenders that are approved to offer VA’s home loan product. What this means is that every lender is more than likely to have different interest rates. Sometimes these differences can be minimal other times they can be substantial.

Don’t be fooled by the big names claiming to offer great rates. We encourage all veterans to call three different mortgage companies and get three different rate quotes. This will ensure you’re getting the best deal for you and your family. In addition to rate, you want to make sure that your fees are in line. Some banks like to offer lower interest rates but charge higher prices. Make sure you look at the whole package and decide what’s best for you and your family.

Now comes the question; “how do I know what the best deal is?”. The first thing to do is to remove the emotional attachment to any particular company. All VA lenders are providing the same loan.

We recommend a straightforward formula when comparing your loan. This formula requires you to get what is called a “loan estimate.” This is an official estimation that all lenders have can provide. Unfortunately, many lenders like to give you something different. This only confuses the situation. Specifically, ask for a “loan estimate” also known as an “LE.”

Once you receive your 2 to 3 loan estimates now, it’s time to compare the differences. Keep in mind, many of the numbers on these forms are estimations and will be the same no matter which letter you use. So let’s focus on what matters.

The first thing to look at is on page 1. This is where you’re going to find the interest rate. Next, go to page 2. Compare all of the fees in box “A..” Box a is where you will find all the lender required fees to obtain the interest rate. Also look in box “B.,” You may find one or two fees in here that are different from the other quotes you receive. Make sure to inquire with your loan officer if anything doesn’t seem to match up.

.png)