One-Time Close Construction Loan: A Guide For Homebuyers Building your dream house can be a…

Is it Still a Good Time To Buy a House in Colorado Springs?

Is it Still a Good Time to Purchase a Home in Colorado Springs?

You are establishing an estate for your family and heirs when you buy a home. Without a doubt, it is an important step to take as soon as it makes sense. According to the National Association of Realtors, homeowners have a $300,000 average net worth compared to a $8,000 average net worth for renters.

Let’s look at why that may be the case:

If you had a property over the last year, you made 20% of the home’s value due to appreciation. That’s $80,000 on a $400,000 home. If our market goes up 10% this year, that a $40,000 gain. If there is more of a long-term average of 5%, then that’s $20,000. In addition to that, in a year you’ve paid down your mortgage about $1,200 and saved a possible $5,000 in taxes because the interest on your home loan is tax deductible.

Can you see that there are many ways that owning a home improves your financial well-being?

Most people can’t possibly save fast enough to match those earnings from owning a home! That is the first reason why it is still a great time to buy a house in Colorado Springs.

A second reason to buy now is that Inflation eats away at your savings. Inflation is the overall rising of prices and we are experiencing a lot of it right now. With the current 7% reported inflation rate, you are losing $3,500 a year in purchasing power if you have $50,000 in a bank account. It does not make sense to keep large amounts of money in a bank account during times of inflation. Savers become losers!

What if you are waiting to purchase because you don’t want to overpay?

In many real estate contracts today, the buyers need to put in an appraisal gap amount that they are willing to pay if the house doesn’t appraise for the purchase price. That sounds to many like it is overpaying.

An appraisal is when a real estate professional comes out and gives an educated guess at the value of a home based on historical data. They look back 6 months and sometimes up to a year to find similar properties that have sold.

Also understand that the appraised value and the market value are different things. You are paying market value to buy a house because the amount you are paying is the amount required by other buyers to purchase the home. Paying more than the appraised value is not necessarily overpaying, since the market value is today’s true price for the home.

Another reason why it is still good time to buy a home is that interest rates are continuing to rise and prices are going up. There’s a good chance you won’t be able to afford the same home next year that you can afford this year.

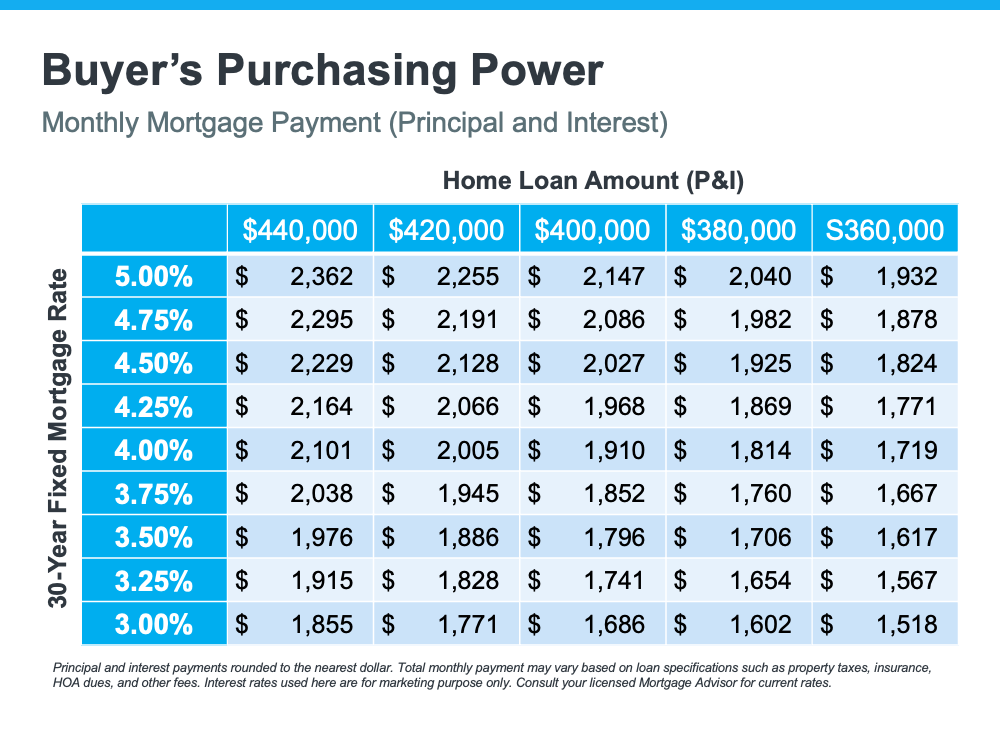

Here’s an example: When interest rates on a loan go from 3.25% to 4.25%, it turns a buyer who could qualify for a $450,000 home purchase to a $400,000 home buyer.

Look at the chart above. It clearly shows that as interest rates go up, the monthly payment at each home price level goes up dramatically.

If you wait two more years, even if you get a $40,000 discount over the current price of a home, the price is still going to be higher than the price you could buy that house for today! And you won’t have benefited from the equity build up, debt pay down, and tax savings over the two years. The final kick in the pants is that your monthly mortgage payment is going to be a lot higher two years from now for the same house because interest rates will be higher than they are today.

Some people are waiting to buy because they think there’s going to be a big crash and home prices are going to drop significantly like they did in 2007 and 2008 during the Great Recession.

Since that housing bubble, there was a 700-page bill called Dodd-Frank to prevent that from happening again. The mortgages made now are all to highly qualified borrowers who can afford their payments. That was not the case back then.

This is not a housing bubble. The dramatic home price increases are based on demand and the extremely low interest rates we’ve had over the last few years. There is a large shortage of single-family houses in Colorado Springs and it’s projected to take three more years of building to catch up. We have people moving here from the coasts of the United States because relative to where they moved from, it is more affordable and a better quality of life here. We have multiple military bases that provide stability to our market. If you look at the facts, there’s just no evidence that there’s going to be a huge market crash in Colorado Springs with a great reduction of prices any time soon.

Prices will eventually cool off as real estate markets have always cycled up and down throughout the history of our country’s monetary system.

What I think is most likely to happen in the next few years is that prices will level off because less buyers will be competing for homes due to the combination of interest rates rising and prices going up. Those factors will make it so some people can no longer qualify for homes. Realize that 30% of real estate home purchases nationwide are by cash buyers so not everyone will be affected by rising interest rates.

In summary, you have a lot to lose and little potential to gain from waiting to purchase a home. It is still a good time to buy a home in Colorado Springs!

Ryan Jahnke, Loan Strategist

NMLS# 2011733

(719) 210-5517