6 minute lesson Lesson Summary Importance of timely document submission for your loan Types of…

Homebuyer 101: Understanding Your Credit Score

Lesson Summary

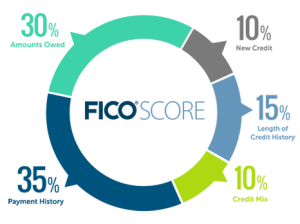

- Credit Score Sources: Compiled by Experian, TransUnion, and Equifax, reflecting your financial activities.

- Payment History (35%): Largest impact on your score. Includes on-time payments and the severity of late payments.

- Amounts Owed (30%): How much you owe versus your credit limit. Lower utilization is better.

- Length of Credit History (15%): Longer credit histories are favorable, showing established financial behavior.

- New Credit (10%): Involves opening new credit lines. Responsible management of new credit can be beneficial.

- Types of Credit Used (10%): A mix of different credit types (installment loans, credit cards) can positively affect your score.

Imagine you’re standing at the threshold of your dream home, keys in hand, ready to cross into a new chapter of life. Your credit score, a numerical reflection of your fiscal responsibility, is the guiding light that led you here.

This score isn’t just a number—it’s a mosaic of your financial history.

Just as a master chef carefully balances flavors to create a culinary masterpiece, your credit activity forms the complex palate of your fiscal reputation.

Decoding Payment History

Payment history, essentially, is the track record of your punctuality on past debts. It’s a clear indicator to lenders of your financial reliability and discipline.

When creditors peek into your financial habits, late or missed payments stick out like sore thumbs, casting doubt on your creditworthiness. On the other hand, a consistent pattern of timely payments paints you as a trustworthy borrower.

Even a single “30-days-late” notice can tarnish an otherwise spotless payment chronicle, possibly hindering loan approvals.

Timeliness Impact on Scores

Your credit score hinges greatly on payment punctuality; a single late payment can leave an indelible mark. Consistently punctual payments, however, cultivate a robust credit foundation.

Payment history carries considerable weight, molding your financial portrait with each bill cycle. Regular, on-time payments reinforce a trustworthy borrower image, essential for mortgage negotiations.

One late payment can affect your credit score for up to seven years.

Maintain vigilance over due dates: sporadic tardiness not only detracts from your score (notably the first 30 days past due), it hints at unreliable financial habits, potentially costing you favorable loan terms. Continual timely payments are your ticket to creditworthiness.

Effects of Delinquency on Credit

Delinquency on credit accounts can significantly lower your credit score and affordability potential. Late payments suggest risk to lenders, negatively impacting your borrowing prospects. Early intervention is key to mitigating damage.

A history marred with late payments implies fiscal irresponsibility, echoing long after the debts are settled. One 60-day delinquency can be more damaging than several 30-day lates, as lenders scrutinize the severity of delinquency.

Ongoing late payments can trigger a downward spiral, as each instance is recorded and compounds the derogatory information on your credit report. This can result in higher interest rates or outright loan disapproval, making homebuying more challenging.

Upon crossing the 90-day delinquency threshold, the impact intensifies. Creditors may mark the debt as a charge-off, exacerbating credit score decline, and further hindering access to competitive mortgage products.

Once a pattern of delinquency is established, it becomes difficult to reverse perceptions of credit risk. Proactive management of bills is paramount for safeguarding your financial standing and future homeownership goals.

Balancing Your Debts

Navigating the delicate dance of debt utilization is pivotal in bolstering your credit score. Think of your debts like a high-wire act; too much weight on one side can lead to a perilous drop. Maintaining your credit utilization ratio— the amount of credit you’re using compared to your available limit—below 30% is a key strategy. This signals to lenders that you’re managing your debts adeptly without overextending your financial capacities, which can, in turn, enhance your credibility and home buying potential.

Understanding Credit Utilization

Credit utilization ratio plays a pivotal role in your credit score health and home-buying readiness.

- Interpret Your Limits: Know each credit account’s limit to understand your potential total credit.

- Calculate Usage: Regularly tally your current balances against these limits.

- Aim for 30% or Less: To optimize credit health, keep utilization below this threshold.

- Monitor Regularly: Staying aware of your credit usage helps prevent creeping over the ideal ratio.

- Adjust as Needed: Pay down balances or request higher limits if utilization runs high.

Intelligent management of your ratio can bolster your credit score.

Careful credit utilization is a strategic aspect in achieving homeownership in Colorado Springs.

Keeping Debt-to-Credit Ratio Healthy

A balanced debt-to-credit ratio signals responsible financial behavior and is vital for a robust credit score.

To achieve a healthy ratio, it’s essential to understand the mechanics behind it. Your debt-to-credit ratio, also known as credit utilization, compares the total debt you’ve assumed to the total credit available to you. Maintaining a ratio of 30% or less is a golden rule, suggesting to lenders that your financial habits are in check and that you pose a lower risk as a borrower.

Effectively managing your credit utilization can be a balancing act, requiring a combination of vigilance and proactive adjustments. By periodically reviewing your credit balances and limits, you’re more likely to catch and address any near-thresholds before they negatively affect your score. Additionally, spreading balances across multiple accounts can prevent any single card from skewing your overall utilization rate unfavorably.

Ultimately, your efforts to control your debt-to-credit ratio can have a profound influence on mortgage terms you may qualify for. Lenders will scrutinize this aspect of your credit profile, discerning your capability to handle new debt. Keeping your utilization low not only fortifies your credit score but also opens the door to more favorable home loan options. Stay diligent—it’s a commitment that can lead to significant savings and a smoother home-buying experience.

Credit Longevity Matters

Time-honored credit lines show a stable financial persona; lenders favor a prolonged, positive history. Your credit’s age isn’t simply about antiquity—it’s a testament to sustained fiscal responsibility. A portfolio spanning years, with consistent, timely payments, commands respect and trust in the eyes of creditors. Astute borrowers know that an earnest credit past forges a path to advantageous lending terms.

Benefits of an Aged Credit History

An aged credit history can act as a beacon of financial reliability to potential lenders. It paints a portrait of creditworthiness, often resulting in trust and credit approval.

Lenders don’t just look for quantity of credit history, but also the quality that time signifies. A long-standing history of punctuality in payments establishes a borrower’s dedication to fiscal responsibility.

For example, older accounts in good standing bolster credit score algorithms, appreciably lifting your score. This signal of credit maturity is invaluable when seeking lower-interest home loans.

Building upon a foundation of aged accounts may offer a safety net during financial hiccups. Credit reporting agencies tend to forgive small mishaps if outweighed by years of positive usage.

Additionally, a seasoned credit line could unlock premium mortgage products from discerning lenders. A robust credit history facilitates negotiations for better loan conditions.

How Early Accounts Boost Your Score

Establishing credit accounts early in life sets a foundation for a solid credit score. Over time, these early accounts mature, amplifying their positive impact on your score.

Consistency with these accounts builds a credit backbone. They act as anchors in your credit history.

Early accounts extend the average age of your credit, a factor in calculating your score. A longer credit history suggests financial stability to lenders.

Open and active early accounts demonstrate commitment to credit management. They show you can handle credit responsibly over extended periods.

These stalwart accounts on your report offer resilience against the negative impact of newer debts. They help maintain balance, just as roots would for a tree, providing stability amidst financial storms.

Moreover, these early account entries in your ledger signal trustworthiness to lenders. They’re historical evidence of your enduring relationship with credit and financial duty.

Wisdom in New Credit

In evaluating new credit, think of it not just as an opportunity, but also as a financial statement to potential lenders. Every time you apply for a new credit line, it’s like casting a pebble into the tranquil pond of your credit report: the ripples reflect your activity. Too many applications in a short span can suggest desperation or financial stress, which lenders view negatively. Walking the thin line between using credit for leverage and overextending requires both strategy and restraint. Display a judicious approach to acquiring new credit, demonstrating to lenders that you have the acumen to use additional credit lines to your advantage without drowning in potential debt.

Calculating the Risks of New Accounts

Taking on new credit is a delicate balance of opportunity and risk assessment.

- Inquiries on Credit: Each application prompts a hard inquiry, potentially dipping your score slightly.

- Short-Term Impacts: Multiple inquiries in a short period can alarm lenders, suggesting possible financial instability.

- Long-Term Strategy: Consider the benefits of a new account against the temporary decrease in your credit score.

Opening a new account may lead to a minor, temporary drop in your credit score.

However, if managed wisely, it can enhance your credit profile over time.

Strategic Credit Inquiries and Their Impact

Credit inquiries can ding your credit score, yet strategic timing and selectivity are key.

- Hard inquiries from lenders after a credit application drop your score temporarily.

- Space out credit applications to minimize the impact on your score.

- Select opportunities that offer substantial benefits versus their credit score cost.

- Avoid rash decisions and pursue credit only when it aligns with long-term financial goals.

Each hard inquiry might shave a few points off, with effects lasting up to a year.

However, a well-timed inquiry for credit that aligns with your financial strategy can be beneficial in the long haul.

When you’re stepping into the world of homeownership, one of the most crucial elements to understand is your credit score. This score, a seemingly simple number, is actually a complex blend of various financial behaviors and history. Let’s break down the five components that make up your credit score, making it easy to understand how it’s calculated and what you can do to improve it.

The Sources of Your Credit Score

Your credit score is derived from information gathered by the three major credit reporting agencies: Experian, TransUnion, and Equifax. These agencies compile data on your financial activities, which then influence your overall credit score.

-

Payment History (35%): The largest portion of your credit score, a whopping 35%, is based on your payment history. This includes whether you make payments on time, and if not, how late these payments are – be it 30, 60, or even 120 days overdue. Consistently paying your bills on time is crucial to maintaining a healthy credit score.

-

Amounts Owed (30%): Next up, accounting for 30% of your score, is the amount of money you currently owe. For instance, if you have a credit card with a $10,000 limit and you owe $1,500, this is more favorable than owing $9,900 on the same limit. It’s all about how much of your available credit you’re using.

-

Length of Credit History (15%): Representing 15% of your score is the length of your credit history. Credit agencies look at how long you’ve had your accounts open. A longer credit history typically works in your favor, indicating a more established financial track record.

-

New Credit (10%): New credit makes up 10% of your score. This involves applying for and using new credit lines. If you’ve had the same few credit cards for many years, occasionally applying for a new one and using it responsibly can positively impact your score. The key is active, yet responsible credit management.

-

Types of Credit Used (10%): Finally, the last 10% of your credit score is determined by the mix of credit you have – this includes installment loans, such as car payments, and revolving credit like credit cards. A diverse mix can positively influence your score.

Understanding these components is vital in preparing for homeownership. By managing these aspects wisely, you can maintain or improve your credit score, which is a significant factor in securing a favorable mortgage. Remember, a healthy credit score opens doors in your home buying journey!

For more information on Colorado real estate and financing, visit 719lending.com.